Personal Financial Planning

Spending Time Building Your Financial Plan Puts You In The Driver's Seat!

The Office of Financial Education is here to help you build your financial future one step at a time. Focusing on the present, and developing an understanding of personal financial planning, is an important first step to gaining the traction you want to be financially secure (whatever that means to you), in the future. Our goal for you – to live like a college student today, so you don’t havetotomorrow!

Let’s get started by first understanding, what is personal financial planning?

Personal financial planning is your opportunity to take control through knowledge of how to manage your finances, planning for the future, and ensure your money worksforyou (savings, future buying power, etc.), not against you (debt). To do this, there are a few ”big picture” items to consider. To get started, here are a few key concepts:

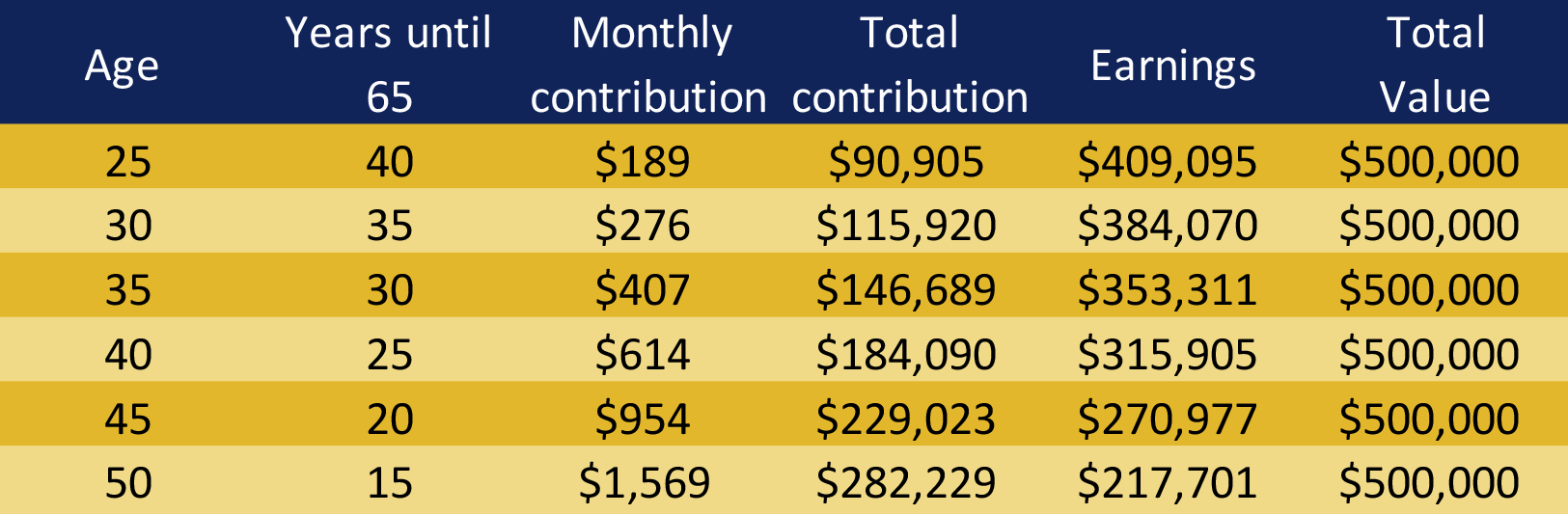

This concept means that money today, will be worth more in the future than an equal sum in the future, due to the potential earning capacity. In simple terms – the earlier you start savings, the better to reach your financial goals than if you wait 5 years, or longer, to begin.

This table represents the power of compound interest. The eariler you start, the less money it takes to reach your goal. Begin investing early to maximize the value of a dollar.

Refers to the best alternative insted of saving or investing your money. We like to look at it as - do you want something now, or something in the future that may take a little longer to obtain. This could be choosing to rent vs. buy. You want to ensure you have done the math, weighed the options and determine what is the best decision for you and your goals/personal circumstances, etc.

This is foundational to your personal financial planning. What are your values? What is most important to you? How you spend your money is a direct reflection of you values, so we recommend assessing what your habits say about your values. If you don't see alignment, sit down and write out your values and begin to consider how money management can help you to realign your habits to better reflect your values. Your goals are a reflection of your values - and by articulating your goals, you can begin to plan for how your funds can help you acheive these goals.

- Definition - train oneself to do something in a controlled and habitual way.

- Personal Financial Planning is about discipline. This doesn’t mean you won’t have fun along the way – you should! – but it does mean saying “no” to something you can’t afford or eating at home when you would rather go out. It’s about being disciplined to ensure you can get where you want to be over time.

- That vacation, life experience, or your first night in a home you own (whatever you goals may be!) will be worth it when you know you worked hard to get there!

With these concepts in mind – we encourage you to use this site, and our professional financial coaches, to help you set goals, learn and implement the strategies that will serve you for the rest of your life.

We can all use a little help from our friends

Check out this great resource from our friends at TIAA to help you along the way.