Student Loans

Debt certainly isn’t always a bad thing. A mortgage can help you afford a home. Student loans can be a necessity in getting a good job. Both are investments worth making and both come with fairly low interest rates. ~ Jean Chatzky

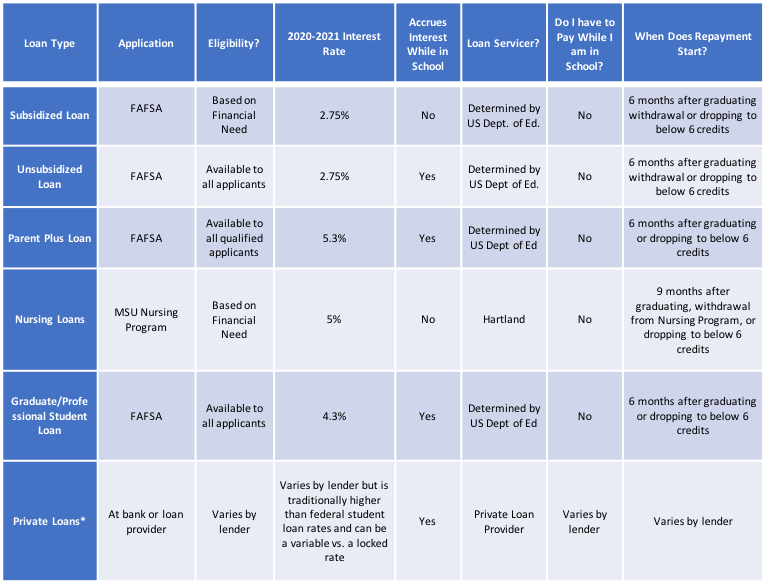

One of the most common ways of paying for school is with Student Loans. Students Loans can be from the federal government or through private lending organizations. The information below will help you understand the different types of loans available and offer links to access loan portals so you can make the best choice for you when financing your education.

But first….The Free Application for Federal Student Aid (FAFSA)!

In order to be considered for federal student loans, grants and many scholarships at the state and institutional level, you must complete the FAFSA. You can learn more about the FAFSA here. Keep in mind, this is the first step to federal student loans and should be completed by the priority deadline (December 1st annually at Montana State University).

FEDERAL STUDENT LOANS:

Federal student loans are made by the government, with terms and conditions that are set by law, and include benefits not typically offered by private loans. These loans offer better rates (in the long run) and more security than private loans. For example, if student loan relief is provided by the Federal Government, as was the case during the COVID-19 Pandemic shut-down in the spring of 2020, only Federal student loans qualified for the temporary suspension of student loan payments.

The Federal Government offers several different loans for undergraduate and graduate students:

Federal Direct Subsidized Loan: awarded to undergraduate students with financial need; the federal government pays the interest on this loan while the student is attending school at least ½ time. Financially speaking, this is the loan that will cost you the least amount of money – no interest accrued while you are in school!

Federal Direct Unsubsidized Loan: awarded to undergraduate students; this loan begins accruing interest upon dispersal (dispersal means as soon as it is paid to your student account).

Parent Plus Loan: a loan parents may apply for on behalf of their dependent student. The student must be admitted into a degree-seeking program and enrolled at least half-time (six credits). This requires the parent qualify for a loan in their own name. We understand this is necessary for some students to pursue their education, however we want to remind you and your parent/family member that this is a loan under THEIR name. Consider this option carefully and make sure it is the right fit for you and your family.

Graduate/Professional Plus Loan: are awarded to graduate students enrolled in at least six credits in a degree-seeking program. There is no annual loan limit for the Graduate PLUS Loans, but students cannot borrow in excess of their cost of attendance.

*Private Loans should be considered very carefully and with a full-understanding of the risks and limitations versus federal loans. Consider with care and use only ifabsolutely necessary.