Economics

|

|

|

Upcoming Events and New Articles

FAMILY FINANCIAL MANAGEMENT MONTGUIDES

Articles, Resources and Useful Links

Does My Land Qualify as Agricultual Land? |

Significant property tax benefits accrue to Montana landowners whose parcels qualify as agricultural lands, especially if a homesite exists on the parcel. |

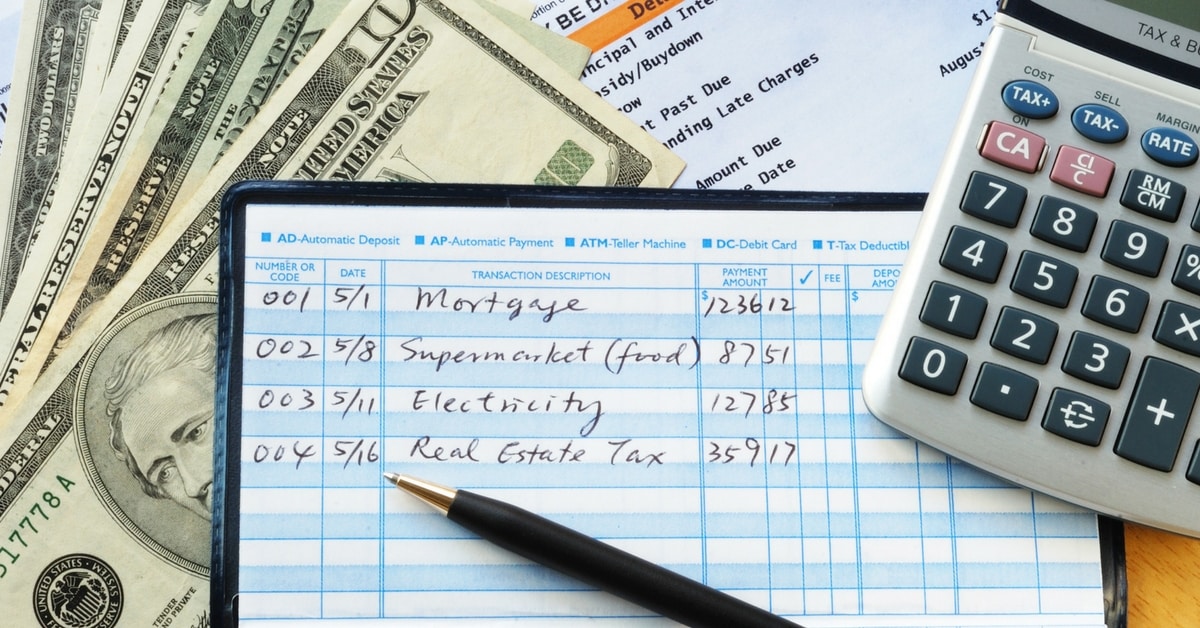

Documenting Home Contents for Insurance Purposes |

Is your home inventory up to date? It can feel overwhelming and take a while to make the first list. But just in case your house burns down, floods, or another disaster strikes, you would have a record of what was owned for insurance purposes. Thank goodness making a household inventory today is much easier when using the tech tools many of us have at our fingertips. |

Forces That Will Shape the U.S. Rural Economy in 2023 |

The U.S. economy still has considerable momentum and is not currently on the verge of recession. However, economists have never been more pessimistic and there are very legitimate reasons for concern. |

| Economic Impact of Agriculture - Judith Basin County (2021) (pdf) | Judith Basin County is a rural sparsely populated county located in the central part of the state. Over 71% of land in Judith Basin County is classified as farm land. Judith Basin County's economic impact on agriculture in Montana can be found here. |

Medicare Basics - How does Medicare Work |

Original Medicare covers most, but not all of the costs for approved health care services and supplies. After you meet your deductible, you pay your share of costs for services and supplies as you get them. There’s no limit on what you’ll pay out-of-pocket in a year unless you have other coverage (like Medigap, Medicaid, or employee or union coverage). |

What is the Farm Services Agency (FSA)? |

The Farm Service Agency (FSA) is part of the United States Department of Agriculture (USDA) and administers many loan, direct payment, and other agricultural assistance programs. People who can benefit from FSA programs include farmers, ranchers, and other agricultural producers, including those getting started in agriculture. |

For More Information Visit: MSU Extension Family Economics

The U.S. Department of Agriculture (USDA), Montana State University and Montana State University Extension prohibit discrimination in all of their programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital and family status. Issued in furtherance of cooperative extension work in agriculture and home economics, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone, Executive Director of Extension, Montana State University, Bozeman, MT 59717.