Talking With Aging Parents About Finances

MT199324HR

Revised 06/23

Provides strategies for diplomatic discussion about family financial issues with aging parents.

AT SOME POINT IN THEIR LIVES, PARENTS AND ADULT children will face the challenge of talking about financial issues associated with

potential chronic illnesses, disabilities, mental incapacity, or death. Rationally,

we may know that planning ahead is the best way to minimize feelings of helplessness

and

stress. Emotionally, however, we may find it difficult to talk about matters that

make us uncomfortable. The situation can be more complicated if there have been years

of underlying tensions, misunderstandings, or disputes among parents and their adult

children.

This MontGuide provides ways to help overcome barriers that often hinder conversations

with aging family members about money. It also explores alternatives to consider if

a parent is healthy and needs minimal help with finances. And lastly, the MontGuide

examines legal options if a court finds one or both parents “incapacitated.”

Each family is unique. While this MontGuide speaks to the adult children of aging

parents, the authors also recognize that sometimes parents are the ones

who need to persuade their adult children to talk about future financial arrangements.

Strategy 1: Plan Ahead

Many families do not discuss finances until a crisis occurs; unfortunately, then it

may be too late to take certain actions. Once a parent suffers mental incapacity,

the options become limited, and procedures become more complicated and costly.

In addition, others – including social workers, physicians, attorneys, judges, and

court-appointed guardians and conservators – may need to become involved in the decisions.

Although such professionals are typically competent, they may not be aware of the

parents’ wishes because they became involved after mental incapacity became an issue.

Adult children may hesitate to discuss financial concerns with their parents for fear

of appearing overly interested in an inheritance. Talking about Mom and Dad’s finances

may mean talking about what happens when Mom or Dad die. Few of us want to start a

conversation with, “Dad, when you

die…” or “Mom, if you become unable to make decisions.…”

Planning requires a person to anticipate difficult and uncertain situations – dependency,

disability, incapacity, and death – and exploring solutions. Discussions can make

family members feel uncomfortable. As adult children, we do not like to think of the

day when our parents may not be able to manage their finances. In fact, parents often

worry about becoming mentally incapacitated, outliving their retirement savings, and

covering the cost of long-term care. Despite these anxieties, there are good reasons

to plan.

Although planning may not reduce the emotional pain resulting from a disability, it

can:

- make decisions easier in challenging times.

- reduce emotional and financial upheaval later in life.

- protect parents’ assets from mismanagement, fraud, or exploitation.

- ensure your parents’ lifestyle, personal philosophies, and choices are known before the time comes when they are not able to actively make decisions.

- increase the options available to parents and their adult children.

- decrease the possibility that adult children will have to take intrusive, restrictive actions such as going to court to seek a guardianship or conservatorship.

- reduce disagreements among siblings about “what Mom or Dad would have wanted.

Planning does not prevent all problems, but it does provide parents with more options

and enable families to act more effectively.

Be sensitive to and acknowledge a parent’s feelings and preferences. Recognize the need to be independent and in control. Do all you can to support a parent’s dignity.

MSU Extension publishes MontGuides (fact sheets) about estate planning, revocable and testamentary trusts, and financial and health care powers of attorney. For more information, visit the MSU Extension Estate Planning website where there are 50 MontGuides (fact sheets) about the various areas involved in estate planning. Other sources of information include AARP, the Montana Senior and Long-Term Care Division, Alzheimer’s Association, and local Area Agency on Aging. (See list of organizations and their websites at the end of this MontGuide.)

Strategy 2: Talking with parents

Discussing the future with aging parents is best while they are healthy and financially

secure. To start the conversation, consider sharing the result of a life event experienced

by a family member or friend, such as a grandparent’s move into a long-term care facility,

the extended hospitalization of a relative following a heart attack, or the death

of a friend who had no written will.

Another way to open the door to a conversation is to share your personal preferences

and plans. Remember, mental incapacity does not just occur in later life. At any age,

a debilitating accident or a head injury may cause incapacity. Parents may question

the motives of adult children who express concern about a parent’s finances and health

care and yet, the adult children have not done planning and prepared their own power

of attorney for finances and another power of attorney for health care.

Give consideration to the timing of a discussion and where to have it. If possible,

avoid discussing finances during emotionally demanding events such as holiday celebrations.

A relaxed, shared activity, such as walking, golfing, fishing, or baking may diffuse

tension when the conversation turns to finances and health care.

Remember, your parents may find it difficult to talk about finances, especially when

discussing potential incapacity, inability to manage finances, and loss of control,

particularly, if they are already experiencing health changes. A parent may express

grief, frustration, uncertainty, and anger. Be sensitive to and acknowledge your parents’

feelings, preferences, and their need to be independent and in control. Try to maintain

your parent’s dignity and respect their wishes.

View the situation from your parent’s perspective. Give your undivided attention and

listen to what your parents are saying. Show empathy and understanding. Parents are

more likely to listen and be open to discussing financial concerns when adult children

are considerate of their feelings.

Some parents have difficulty accepting any financial counsel, especially from their

adult children. Try to keep a balance between providing assistance and assuming control.

Parents are likely to resist if you try to take over.

An effective way to start a discussion is for all family members to express positive

intentions and a willingness to listen carefully. The goal is to set the right tone.

Avoid an aggressive approach which is likely to sound like a power play. Do not say

or approach the discussion with an attitude of, “You are going to have financial problems

as you get older, and I know how to solve them for you.” Make it clear that you are

acting out of concern, not self-interest. An effective way to express this concern

is to begin with an “I message” instead of “You message.” An example could be “I’m

worried if something happens to either one of you, we won’t know what bills need to

be paid.” Or “With the rising costs of health care, I’m concerned that a major illness

could wipe out your savings.”

Respect your parents’ right to make choices while they have the capability of doing

so. A parent’s view of what is best may differ from that of their adult children.

This does not mean that any one viewpoint is wrong. Differences of opinion often result

from different attitudes, values, or desires. Even if you disagree with your parent’s

preferences, show respect for their choices. This is essential for an open discussion.

Unless a parent has clearly passed the point of effective functioning, you should

not presume to decide what is best. If your parents are healthy and capable, the involvement

of other family members in their financial affairs should be by invitation only. Although

it may be frustrating to you, it is legitimate for parents to say they choose not

to talk about certain topics with the “kids.” They have a right to financial privacy.

If your parents do not feel comfortable talking directly with you about their personal

finances, suggest that they talk to another trusted family member, an attorney, or

a financial advisor. Another possibility is to send your parents books, email articles,

MSU Extension MontGuides, and links to webinars or podcasts.

Family Finance Discussion Points

- Do you have a will? If so, where is it stored?

- Have you granted someone a power of attorney for financial affairs? If so, who has the power and where is the document stored? (See MontGuide, Power of Attorney (Financial), MT199001HR.)

- Have you written a power of attorney for health care? (See Health Care Power of Attorney

and Related Documents for Montanans, EB0231.) If so, who has the power, and where is the document stored? Is your Health Care

Power of Attorney registered at the Montana End-of-Life Registry?

(See MontGuide, Montana’s End-of-Life Registry, MT200602HR.) - Do you have a safe deposit box? What financial institution has the box and where is the key? Where is the list of contents?

- What is the location of essential personal papers – birth and marriage certificates, dissolution of marriage documents, Social Security, and military service records? (See MontGuide, Your Important Papers: What to Keep and Where, MT199611HR.)

- Where are your life, health, and property insurance policies?

- Have you made a list of investments (savings accounts, certificates of deposit, stocks, bonds, and mutual funds)? What is the contact information for the institutions that have your investments?

- Have you made a list of the personal and real property that you own? Where is the list?

- Who are your financial advisors? What is their contact information?

- Have you developed a letter of last instruction? If so, where is it stored? (See MontGuide, Letter of Last Instructions, MT198904HR.)

- If you have a retirement program, is there a death benefit for survivors? If so, whom should the survivors contact?

Strategy 3: Hold a family meeting

Another approach is to arrange a family meeting. Explain to your parents that you

and your siblings would like to discuss some concerns at a convenient time. The family

member your parent has the most trust in may be the best person to arrange the meeting.

During the meeting, family members can discuss how the parents would like to have

their financial and health care decisions made if one or both parents developed a

chronic illness, became physically disabled or mentally incapacitated, or died.

Involvement of family members. Your parents’ wishes should decide who takes part in the discussions. Some families

find it beneficial to include as many immediate family members as possible. Excluding

an adult child may result in problems later. If a parent has divorced and remarried,

include the new

spouse. Parents should decide whether they are comfortable with sons-in-law and daughters-in-law

to be present. Everyone who attends should respect the parents’ need for privacy about

their health and finances.

If family relations are tense, have a professional outside of the family— an attorney,

financial planner, social worker, family counselor or therapist—facilitate the meeting.

Often, the presence of an outside facilitator can keep a meeting calm and more productive.

Consider, however, a family member may not be as open as they otherwise would be because

of a non-family presence. Another family member may feel more comfortable being fully

upfront and open with a professional, rather than when a family member facilitates

the meeting. Your family needs to decide what is best.

Prepare for the meeting. Before the family meeting, make a list of concerns and questions to discuss. See

list of discussion points above. Remember, some parents may not want all family members

to know the details of their financial situation. What is important is whether the

parent has:

- gathered financial information,

- made known to at least one family member the location of important papers,

- prepared for the possibility of incapacity and considered how to pay for long-term care, if needed.

Before beginning the meeting, decide who will take notes. At least one person should record items requiring follow-up, such as confirming who volunteers to find information about a financial or health care power of attorney or to research the cost of long-term care insurance policies.

At the meeting, start with the basics. Begin by making a list of where parents store their financial documents. Important

records include savings and investment accounts, Social Security numbers, insurance

policies, pensions, contracts, and debts. Be sure to include any real property owned

such as a home or land. While expressing concern about your parents’ financial records,

you also should be able to account for your own. Your parents may question your sincerity

if you say they should have this type of list when you do not have one yourself.

Be willing to compromise. A mother who has said she will not go to a local care facility may prefer this possibility

rather than living with a daughter whose home is 1,500 miles away in another state.

In the local care facility, friends and relatives could stop by and visit. In her

daughter’s community, the mother may not know anyone. Do not make financial decisions

for your parents during the meeting. Keep in mind the purpose of the meeting is to

discuss financial and health care issues and to be understanding of and cooperative

with your parents.

Follow up on the discussion. At the end of the meeting, review the notes and encourage everyone to act promptly

on any tasks they agreed to do. A son may check into the costs of long-term care insurance

policies while a daughter requests a copy of the MSU Extension MontGuide, Power of

Attorney (Financial) from her local Extension office. One parent may visit the local

Area Agency on Aging, while the other contacts AARP for information or downloads a

MontGuide from the MSU Extension estate planning website.

Other actions may involve setting up a meeting with an attorney or financial planner

to answer questions about estate planning and other matters. If parents cannot do

tasks, divide tasks among family members based on time available, skills, and geographic

proximity. Parents who are capable may be able to complete some tasks themselves.

Appreciate your parent’s capabilities. Too often, adult children tend to focus on what parents cannot do. Instead, focus

on what your parent can do. Allow parents as much control as possible over their finances

and activities.

Helping parents with their finances

A parent who has limited mobility, low vision, loss of hand dexterity, or failing

memory may ask for help in managing their finances. Needs may include reading fine

print, balancing a checkbook, preparing checks for signature, or dealing with Medicare

and other benefit programs. A parent with severe disabilities may need someone to

manage all their financial affairs.

There are several options for individuals who need help with managing their finances

or may need help in the future. These include joint checking accounts or a multiple

party account without survivorship, a financial and a health care power of attorney,

a revocable trust, a testamentary trust, appointment of a representative payee, conservatorship,

and guardianship. Each has advantages and disadvantages to consider.

JOINT CHECKING ACCOUNTS

Joint checking accounts provide an effortless way to sign checks and pay your parent’s bills while they maintain a sense of control, particularly if they retain the checkbook. A parent can set up a joint account by adding the name of an adult child on both the checks and signature card. This is known as a joint tenant with right of survivorship account. The adult child joint owner will have equal access to the account as the parent. This also means the joint owner receives the balance in the account when the parent dies. Other family members do not receiveany assets in the joint account. The joint tenancy overrides any bequests written in a will. If not effectively managed, a joint tenancy with right of survivorship account can present complications with taxes, eligibility for government benefits, and disposal of funds at death for either party.

Example A: Ms. Jones wrote in her will she wanted the balance of $50,000 in her checking account to go to her daughter, Susie. However, the assets did not go to Susie because Ms. Jones had the account in joint tenancy with right of survivorship with her son, Brian. If Ms. Jones had the account in her name only, Brian would not receive the $50,000. Instead, the money passes to Susie as listed in the will of Ms. Jones.

MULTIPLE-PARTY ACCOUNTS WITHOUT RIGHT OF SURVIVORSHIP

The funds in multiple-party accounts are accessible by two or more parties whose names

are on the account. With multipleparty accounts without right of survivorship, one

party could withdraw the entire amount in the account. At the death of the owners

of the account, proceeds are distributed according

to the deceased person’s written will or to heirs based on Montana law.

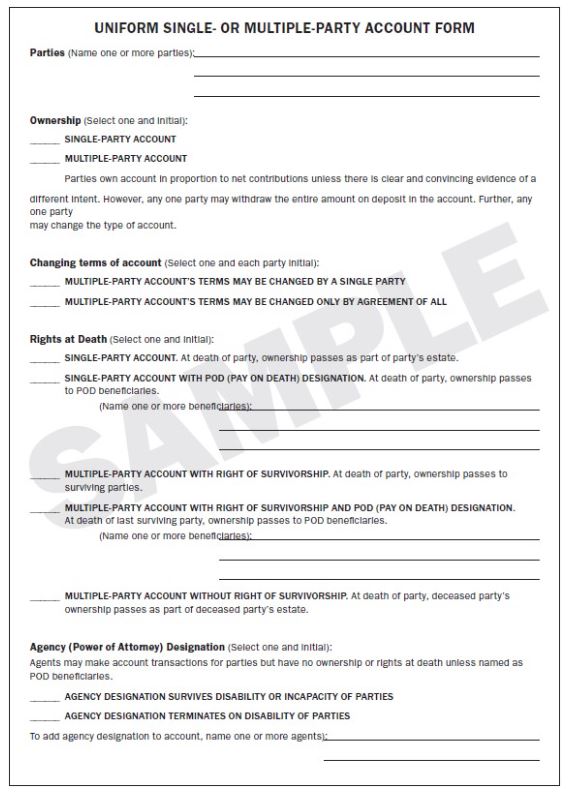

Example B: Jane has $150,000 in her savings account. After reviewing the form (at right) she

decided to mark the multiple-party account without right of survivorship box on the

form. She added her daughter’s name to the account. At Jane’s death, the $150,000

will be divided according to her written will equally among her three children, not

all to the daughter who had her name on the account. Why? Because it was an account

without right of survivorship.

The Montana statute has a uniform single- or multiple-party account form that financial

institutions may use, although it is not a requirement. The form features a convenient

checklist that allows a depositor to choose among the types of accounts. (See form

at right). Explore the full legal consequences of a multiple-party account with an

attorney before selecting this choice.

REPRESENTATIVE PAYEE

If a disability makes it difficult for a parent to manage Social Security, Veteran’s payments or public benefits income, an adult child, other relative or caregiver may become a Representative Payee to receive and disburse funds for the person. To arrange for representative payee status, contact the proper agency for an application form and instructions. One requirement is a medical confirmation document that the parent is not able to manage benefit payments. The benefit agency has instructions on how funds in the account are to be titled, accounted for, managed, and disbursed by the representative payee.

FINANCIAL POWER OF ATTORNEY

A financial power of attorney is a written document in which a person (the principal) gives another

person (the agent) legal authority to act on their behalf in financial transactions.

Having confidence in the person (the agent) to whom you give your financial power of attorney is critical since no agency or court supervises the person who is

granted a financial power of attorney.

A person (principal) may give either a general power of attorney or a special power of attorney. A general power of attorney gives a broad grant of power to the person named as the attorney-in-fact

to perform any financial transactions on behalf of the principal that the person could

do. A special power of attorney authorizes the designated person to do a limited number of financial

transactions or only one transaction such as withdrawing a specified sum of money

from a savings account to pay bills.

A person can grant a financial power of attorney to last for a specific period such

as a month, or for an indefinite time. In either situation, the principal has the

right to revoke or withdraw the power at any time upon notice of intent to the person

who holds the power of attorney and other interested persons. A financial power of

attorney automatically ends on the death of the principal.

A durable power of attorney does not end if the person granting the power becomes mentally

incapacitated. All financial powers of attorney are durable under Montana law unless

noted in the document. A durable power of attorney can also “spring” into existence only if a person becomes incapacitated

or incompetent, as diagnosed by a physician, and is unable to direct their personal

affairs. However, a “springing clause” must written very clearly or it may not be

honored by financial institutions. (For more information, see MontGuide, Power of

Attorney (Financial), MT199001HR.)

REVOCABLE TRUST

A revocable trust is another way people can assure management and protection of assets

if they become incapacitated in the future. A trust is an arrangement whereby a person

(settlor) transfers specific assets to another person (trustee) who holds and manages

the assets for the benefit of the beneficiary. The settlor, trustee, and beneficiary

may be the same person, or they can be different.

The trust agreement has specific instructions about the management and distribution

of the assets to the beneficiary. For example, a mother may name herself as trustee

of her assets until she becomes incapacitated, at which time her successor trustee,

a daughter, will take over the duties of trustee.

Unlike a will, a trust is not subject to probate and does not become a matter of public

record. An attorney’s legal assistance in setting up a trust is a way to protect everyone’s

interests. The attorney drafting the trust should understand restrictions on Medicaid

eligibility for the grantors of revocable trusts, particularly if there is any possibility

the grantor may need long-term care. (For more information, see MontGuides, Revocable

Living Trusts, MT199612HR, and Medicaid and Long-Term Care Costs, MT199511HR.)

TESTAMENTARY TRUST

A testamentary trust allows a trustee to manage assets on behalf of a beneficiary.

A settlor is a person who creates a testamentary trust. The terms of the trust are

in the settlor’s written will. A testamentary trust does not legally exist until the

settlor dies and the will of the settlor passes through the probate process. (See

MontGuide, Testamentary Trusts in Montana, MT202113HR.)

The settlor can specify in a written will which assets pass to the testamentary trust

after the settlor dies. Like the settlor of a revocable trust, the settlor of a testamentary

trust can transfer most any kind of asset into a testamentary trust. Additionally,

life insurance policies, annuity policies, and pensions may allow the policy holder

to list a testamentary trust as the beneficiary to receive the proceeds. Check with

each company’s policy to find if this beneficiary option

is available.

CONSERVATORSHIP

A conservatorship is a protective relationship whereby the court appoints an individual

to manage another person’s financial affairs after that person has become unable to

do so. An attorney must file a petition with the court and a judge decides if the

person is legally competent to manage their finances. Other rights such as the right

to vote,to marry or to write a will remain intact. The conservator is responsible

to the court and must make an annual accounting of money spent on behalf of the incapacitated

person.

GUARDIANSHIP

A guardianship is an appointed protective arrangement for a person found by a court

to be incapacitated and in need of someone to oversee their personal freedom of movement

and decision-making. The purpose of a guardianship is to assure the person’s essential

requirements for physical health and safety are met. Montana law defines an incapacitated

person as “anyone who is impaired by reason of mental illness, mental deficiency,

physical illness or disability, chronic use of drugs, chronic intoxication or other

cause to the extent the person lacks sufficient understanding or capacity to make

or communicate responsible decisions.”

The court may grant a guardianship only if it is necessary to promote and protect

the well-being of the incapacitated person. A limited guardianship has rights, powers

and duties specified by the court.

Montana law requires every guardian and conservator to complete an “Acknowledgement

of Fiduciary Relationship and Obligations.” The form is available online at https://www.montana.edu/estateplanning/acknowledgementoffiduciaryrelationship.pdf. This record should be a part of the court records with a

copy for the guardian and conservator.

Understanding the financial and legal issues involved in planning for incapacity may help to protect parents’ assets from mismanagement, fraud, or exploitation.

Summary

Facing the possibility of dependency, disability, or incapacity– not only of our aging parents, but also of ourselves – is difficult, but planning is wise. Planning can help families avoid disagreements about care and finances and help alleviate the stress of making tough decisions in crisis situations. Understanding the financial and legal issues involved in planning for incapacity may help protect parents’ assets from mismanagement, fraud, or exploitation.

Further Information

MONTGUIDES

Montana State University Extension publishes MontGuides written to help families with

estate planning. Over 50 are available online at http://montana.edu/estateplanning/eppublications.html.

For paper copies, contact your local MSU Extension office or Extension Publications,

P.O. Box 172040, Montana State University, Bozeman, MT 59717; (406) 994-3273.

ORGANIZATIONS

Montana Department of Public Health and Human Services, Senior and Long-Term Care

Division

111 N. Sanders, Room 210

Helena MT 59604

800-332-2272

https://dphhs.mt.gov/

Area Agencies on Aging

Toll Free: 800-551-3191

AARP Montana

30 W 14th St, Suite 301

Helena MT 59601

866-295-7278

https://states.aarp.org/montana/

INFORMATIONAL WEBSITES

- 5 Tips for Talking with Your Aging Parents About Their Finances and Health, Merrill Edge. Bank of America. www.merrilledge.com/article/caring-foraging-parents

- Acosta, Kim. How to Talk to Your Aging Parents about Finances. www.aplaceformom.com/caregiverresources/articles/talk-finances-with-aging-parents

Accessed October 2021. - Alterman, Liz. 5 tough financial conversations to have with your aging parents—and how to tackle them. www.care.com/c/financial-conversations-to-have-withaging-parents/ Accessed October 2022.

- Huddleston, Cameron. How to Talk AboutMoney with Aging Parents. https://www.huffpost.com/entry/how-to-talk-about-money-w_b_7849228

Accessed July 2015. - Johnston, Lori. Talking to Elderly Parents About Finances. www.agingcare.com/articles/talking-toaging-parents-about-money-150098.htm

- Munk, Cheryl Wind Okur. How to Talk to Your Aging Parents About Their Finances. And Why it Matters Now. www.barrons.com/articles/how-to-talkto-your-aging-parents-about-their-finances-and-why-itmatters-now-51631887099 Accessed September 2021.

Acknowledgments

Representatives from the Business, Estates, Trusts, Tax and Real Property Law Section,

State Bar of Montana have reviewed this MontGuide. They recommend its reading by adult

children who want to have a discussion with their parents about finances. The authors

express appreciation to Montana Extension agents

and other MSU faculty for their valuable suggestions.

To download more free online MontGuides or order other publications, visit our online catalog at https://store.msuextension.org/ ,contact your county or reservation MSU Extension office, or e-mail [email protected].

Copyright © 2023 MSU Extension

We encourage the use of this document for nonprofit educational purposes. This document

may be reprinted for nonprofit educational purposes if no endorsement of a commercial

product, service or company is stated or implied, and if appropriate credit is given

to the author and MSU Extension. To use these documents in electronic formats, permission

must be sought from the Extension Communications Director, 135 Culbertson Hall, Montana

State University, Bozeman, MT 59717; E-mail: [email protected] The U.S. Department of Agriculture (USDA), Montana State University and Montana State

University Extension prohibit discrimination in all of their programs and activities

on the basis of race, color, national origin, gender, religion, age, disability, political

beliefs, sexual orientation, and marital and family status. Issued in furtherance

of cooperative extension work in agriculture and home economics, acts of May 8 and

June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone,

Director of Extension, Montana State University, Bozeman, MT 59717.