1098-T Form – American Opportunity or Lifetime Learning Tax Credit

- What is a 1098-T form and what should I do with it?

- How will I receive my 1098-T form?

- Why didn't I get a 1098-T form?

- How can I get a copy of my 1098-T form?

- What payments and tuition and fees are included in qualified expenses?

- What is included in scholarships and grants?

- When will the 1098-T be available for 2024?

- What terms are included on the 1098-T?

- How may I receive information on my spouse's or child's 1098-T form?

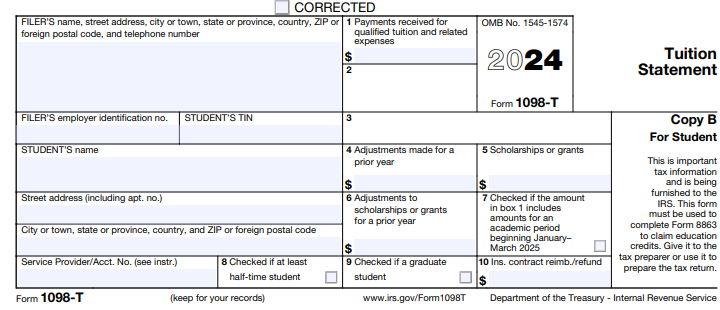

- Can you explain the boxes on the 1098-T form?

- Disclosure statement to receive your Form 1098-T electronically:I've consented to receive my 1098-T form electronically. What do I need to know?

What is a 1098-T form and what I should do with it?

1098-T forms are issued by the university to students that made a payment for qualified tuition and fees during a given calendar year. This form is to be used by the student to determine eligibility to receive the American Opportunity credit or Lifetime Learning education tax credits. The 1098-T form can be kept with your records and does not need to be sent to the IRS with your income tax return as the university sends your 1098-T information to the IRS. More information can be found at the IRS.

How will I receive my 1098-T form?

The 2024 1098-T forms will be mailed out to students by January 31, 2025. The address where the 1098-T form will be sent is as follows: permanent (1st), mailing (2nd), campus housing (3rd), then origin (4th). If you have not received the paper 1098-T form, you can log into MyInfo and print the form from Student Services > Student Records > Tax Notification after January 20th, 2025.

Why didn't I get a 1098-T form?

There are several reasons you may not have received a 1098-T form. The most common reason is that the tuition and fees less scholarships and grants for the 2024 tax year was $0. If this is the case, no 1098-T form will be generated.

If you believe the 1098-T form was sent to an incorrect address, log into MyInfo and print the form from Student Services > Student Record > Tax Notification page.

How can I get a copy of my 1098-T form?

Log into MyInfo and reprint the form from Student Services > Student Records > Tax Notification.

What payments and qualified tuition and fees are included?

Starting in 2018, institutions must report Box 1 the total amount of payments received for qualified tuition and fees. Box 2 will be blank.

Payments include personal payments by checks or credit cards, financial aid payments, and third-party payments up to the amount of qualified tuition and fees.

Qualified expenses would include tuition, mandatory fees, and course fees. Fees that are excluded include application fees, housing and dining, parking, administrative fees and fines. For a full description of the fees on your 1098-T form, please login to MyInfo and select Student Services > Student Records > Tax Notification and scroll to the bottom of your 1098-T form to view your qualified expenses.

What is included in scholarships and grants?

Internal and external scholarships, tuition waivers, grants (federal and state), exemptions and third-party payments from vendors such as ROTC, and employer assistance would be included in scholarships and grants and would reduce the amount of eligible expenses that can be reported.

For a full description of these amounts on your 1098-T form, please login to MyInfo and select Student Services > Student Records > Tax Notification and scroll to the bottom of your 1098-T form to view your scholarship and grant amounts.

When will the 1098-T be available for 2024?

The 2024 1098-T form will be mailed to students by January 31, 2025 If you have not received the form or would like to obtain a copy you can retrieve it from MyInfo under Student Services > Student Records > Tax Notification.

What terms are included on the 1098-T?

For 2024, Montana State University will report Spring 2024 (only payments posted after January 1, 2024), Summer 2024, Fall 2024, and Spring 2025 (only payments posted by December 31, 2024). Payments for Spring 2025 received on or after January 1, 2025 will be reported on the 1098-T statement for 2025.

How may I receive information on my spouse's or child's 1098-T form?

This information is part of the student's private educational records which are protected by federal privacy laws. We are unable to disclose information to anyone without written consent by the student. If a student wishes to release this information, they will need to go to Student Accounts Office and complete a FERPA form. Your child or spouse can print a copy of the 1098-T form from their account on MyInfo on the Student Services > Student Records > Tax Notification page.

Can you explain the boxes on the 1098-T form?

Box 1–Payments received for Qualified Tuition and Related Expenses.

Box 1 shows the total payment for qualified tuition and related expenses less any refunds or related reductions in charges. The amount shown in Box 1 for payments of qualified tuition and related expenses billed during the calendar year may represent an amount that is different from the amount actually paid during the calendar year, although for many students the amounts will be the same. For purposes of the Form 1098-T provided by MSU, the following categories of charges are included or not included in qualified tuition and related expenses:

|

Included |

Not Included |

|

• Tuition – Undergraduate/Graduate • Student Fees • Course Fees and Program Fees

|

• Residence Hall Charges • Application Fees • Transcript Fees • Diploma Fees • Insurance • Advances for books and other expenses that were issued directly to the student |

Under section 25A of the Internal Revenue Code and the associated regulations, a taxpayer may take a tuition and fee deduction or claim an education tax credit only with respect to qualified tuition and related expenses actually paid during the calendar year. More information regarding qualified educational expenses can be found in Publication 970 on the IRS.gov <https://www.irs.gov/forms-pubs/about-publication-970> website.

Box 2-Will be blank

Box 3-Will be blank

Box 4-Adjustments Made For a Prior Year

Shows any adjustment made for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T.

Box 5-Scholarships or Grants

Box 5 of Form 1098-T reports the total of scholarships or grants processed by MSU

during the calendar year. The amount of scholarships or grants for the calendar year

may reduce the amount of any allowable tuition and fees deduction or the education

credit you may claim for the year.

The amount reported in Box 5 does not include:

|

• Student loans; for example, subsidized, unsubsidized, PLUS, Perkins, and alternative loans. • Federal work-study. • Scholarships, grants, and reimbursements that were not administered or processed by MSU. |

The taxpayer’s personal records of what he or she paid during the calendar year must support tax credits. Each taxpayer and his or her tax advisor must make the final determination of qualifying expenses.

Box 6-Total adjustments to scholarships or grants for a prior year

This amount may affect the amount of any allowable tuition and fees deduction or education credit you may claim for the prior year. The amount reported in Box 6 represents a reduction in scholarships or grants reported for a prior calendar year.

Box 7

If this box is checked, the amount in Box 1 includes amounts for an academic period beginning January-March 2025 that were posted in 2024.

Box 8

Shows whether you are considered to be carrying at least one-half the normal full-time workload for your course of study at MSU. If you are at least a half-time student for at least one academic period that begins during the year, you meet one of the requirements for the American Opportunity Act Credit.

Box 9

Shows whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential. If you are enrolled in a graduate program, you are not eligible for the American Opportunity credit, but you may qualify for the tuition and fees deduction or the Lifetime Learning Credit.

Box 10

Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. The amount of reimbursements or refunds for the calendar year may reduce the amount of any allowable tuition and fees deduction or education credit you may claim for the year.

PLEASE NOTE: Not ALL boxes need to be populated. Box 2 and Box 3 will be empty. In many cases, Boxes 4, 6, and 7 will be empty. Box 5 will ONLY be populated if you received scholarships or grants this year.

It is up to each taxpayer to determine eligibility for the credits and how to calculate them. For more information about the deduction or credit, see Pub. 970, Tax Benefits for Education, Form 8863, Education Credits, and the Form 1040 or 1040A instructions.

Disclosure Statement to Receive Form 1098-T Electronically:

I’ve consented to receive my 1098-T form electronically. What do I need to know?

If you have consented to receive your Form 1098-T Tuition Statement (“statement”) electronically you may access your statement online via MyInfo. If you do not consent to receive your statement electronically, MSU will furnish one paper copy by US Mail to your most recent permanent or mailing address in MyInfo.

Your statement will always be available online through at least October 15th (or the first business day after October 15th, if October 15th falls on a Saturday, Sunday, or legal holiday) of the year following the applicable tax year. Our current system retains the 1098-T form for a longer period of time.

Your electronic consent applies to statements furnished every year after the consent is given until you withdraw it.

Bozeman:

You may withdraw your electronic consent by logging in to MyInfo and select Student Services > Student Records > 1098-T Tax Electronic Consent Form and unchecking the electronic consent checkbox. You may also withdraw your consent by sending a written notice including your full name and student ID number to Director of Student Accounts, Montana State University, PO Box 172640, Bozeman, MT 59717-2640. MSU will confirm your withdrawal and effective date in writing to the mailing address from which we received your notice of withdrawal.

Billings:

You may withdraw your electronic consent by logging in to MyInfo and select Student Services > Student Records > 1098-T Tax Electronic Consent Form and unchecking the electronic consent checkbox. You may also withdraw your consent by sending a written notice including your full name and student ID number to Business Services, Student Accounts, 1500 University Drive, MSU Billings, Billings, MT 59101. MSU will confirm your withdrawal and effective date in writing to the mailing address from which we received your notice of withdrawal.

Great Falls:

You may withdraw your electronic consent by logging in to MyInfo and select Student Services > Student Records > 1098-T Tax Electronic Consent Form and unchecking the electronic consent checkbox. You may also withdraw your consent by sending a written notice including your full name and student ID number to 2100 16th Avenue South, Great Falls College MSU, Great Falls, MT 59405. MSU will confirm your withdrawal and effective date in writing to the mailing address from which we received your notice of withdrawal.

Havre:

You may withdraw your electronic consent by logging in to MyInfo and select Student Services > Student Records > 1098-T Tax Electronic Consent Form and unchecking the electronic consent checkbox. You may also withdraw your consent by sending a written notice including your full name and student ID number to P.O. Box 7751, MSU-Northern, Havre, MT 59501-7751. MSU will confirm your withdrawal and effective date in writing to the mailing address from which we received your notice of withdrawal.